There are two types of credit reports generated. There is a consumer credit report and a lender’s credit report – and they are different.

Lenders are required to use a lender’s credit report with lender’s FICO credit scores. Consumer credit reports are available to consumers with different credit scores – usually called Vantage Scores.

Consumer Credit Reports and Scores

Consumer credit reports contain generic information and lacks the details and accurate score information found with lender’s credit reports. Other companies have created “Credit scores” that try to mimic the Classic FICO Scores used by lenders.

These non-lender credit scores often cause confusion about the actual credit qualification of every consumer.

These non-lender credit scores are offered by many credit, financial and other service companies. Unfortunately,

the scores offered there are not the same scores used by your mortgage, auto and credit card lenders. These scores are considered “unreliable” by lenders.

The Problem of Following Inaccurate Credit Scores

Knowing which credit score to track is critical to understanding your true credit standing with lenders. Here is a breakdown of the types of credit scores used:

| Lender |

Score Model |

| 1. Mortgage |

Classic FICO® Scores |

| 2. Auto Lenders |

Classic FICO Scores (65% of Auto Lenders))

Auto (FICO 8) Score (35% of Auto Lenders)

|

| 3. Credit Card Co. |

Classic FICO Scores (70% of Credit Card Lenders)

Bank Card (FICO 8) Score (35% of Credit Card Lenders)

|

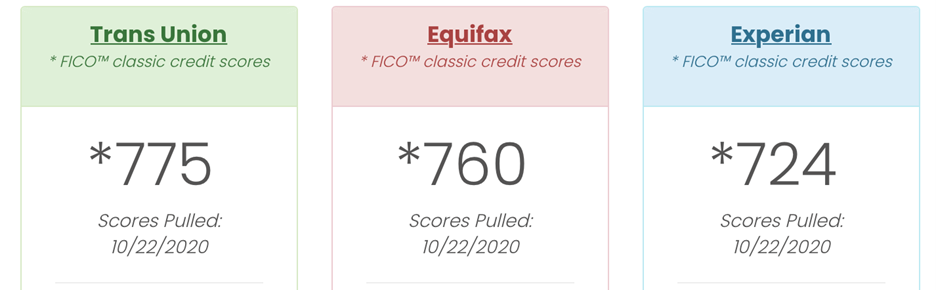

My Credit Plan provides the Classic FICO Scores used by all mortgage lenders, and most auto and credit card lenders.

The Consumer Financial Protection Bureau has warned consumers about following inaccurate scores. These inaccurate credit scores are found on the internet on many consumer websites such as Credit Karma, Credit Sesame, and other credit websites.

The CFPB writes:

Variations between the credit scores sold to consumers and to lenders carry significance only if such variations lead to consumer harms. The July 19, 2011 CFPB Report highlighted potential harms for consumers. These harms include those resulting from consumers’ inaccurate perceptions of their own credit worthiness.

A consumer can face harms if, after purchasing a credit score, the consumer has a different impression of his or her creditworthiness than a lender would.

If the score leads the consumer to overestimate lenders’ likely assessment of his or her creditworthiness,

the consumer might be likely to apply for credit lines that would not be approved, with a cost of wasted time and effort on both the consumer’s and lender’s part. Alternatively,

the consumer may reject offers of credit that would be beneficial because the consumer’s misperception of his or her creditworthiness leads the consumer to believe that the

offers are over-priced.

If a consumer underestimates lenders’ likely assessment of his or her creditworthiness, the consumer might fail to apply for credit at all or delay applying for credit,

forgoing the opportunity to buy a house or car, for example, or delaying a valuable mortgage refinancing. A consumer might also apply to lenders who offer less favorable terms

than he or she might qualify for, or accept less favorable offers received through the mail or online direct marketing. In this case, the cost to the affected consumer

would be higher interest costs and possibly higher likelihoods of default due to the greater costs and difficulty of making monthly payments. Lenders might benefit by

being able to charge higher interest to consumers who “incorrectly” understand their options when applying; at the same time lenders would lose out on business

from consumers who decide not to apply for credit due to a misperception of its likely cost.

https://files.consumerfinance.gov/f/201209_Analysis_Differences_Consumer_Credit.pdf

Deceiving Consumers about Credit Scores

The Consumer Financial Protection Bureau has even fined several companies for deceiving consumers by marketing inaccurate and unreliable credit scores as “…ones used by lenders.”

The CFPB writes:

The Consumer Financial Protection Bureau (CFPB) today took action against Experian and its subsidiaries for deceiving consumers about the use of credit scores it

sold to consumers. Experian claimed the credit scores it marketed and provided to consumers were used by lenders to make credit decisions. In fact, lenders

did not use Experian’s scores to make those decisions. The CFPB ordered Experian to truthfully represent how its credit scores are used. Experian must also pay

a civil penalty of $3 million.

Don’t you want to know the correct FICO Scores used by lenders? We can help you with that by establishing an account with My Credit Plan.

You can read more by clicking here:

https://www.consumerfinance.gov/about-us/blog/millions-of-consumers-will-now-have-access-to-credit-scores-and-reports-through-nonprofit-counselors/