Since My Credit Plan provides the same credit scores and reports used by most lenders, My Credit Plan can provide your mortgage and auto loan qualifications without going to a lender.

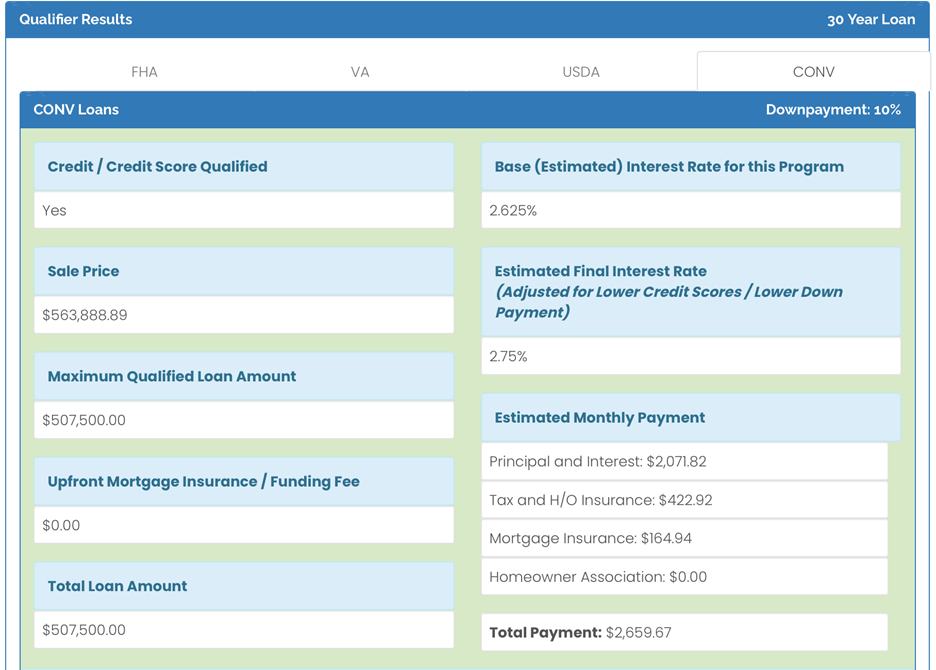

Mortgage Loan Qualifications

In this situation, a person is electing to put 10% on a new home and wants to know his qualifications for a 30-year mortgage.

My Credit Plan identifies that the maximum qualified loan amount is $507,500.

Interest rate and mortgage insurance adjustments made by lenders are provided in My Credit Plan so that the you can have accurate information.

You must still have your income, assets and other information to be reviewed

by a qualified lender - and credit scores may change from day to day.

This still is a one and only opportunity to check your qualifications before you go to a lender and start looking for a home.

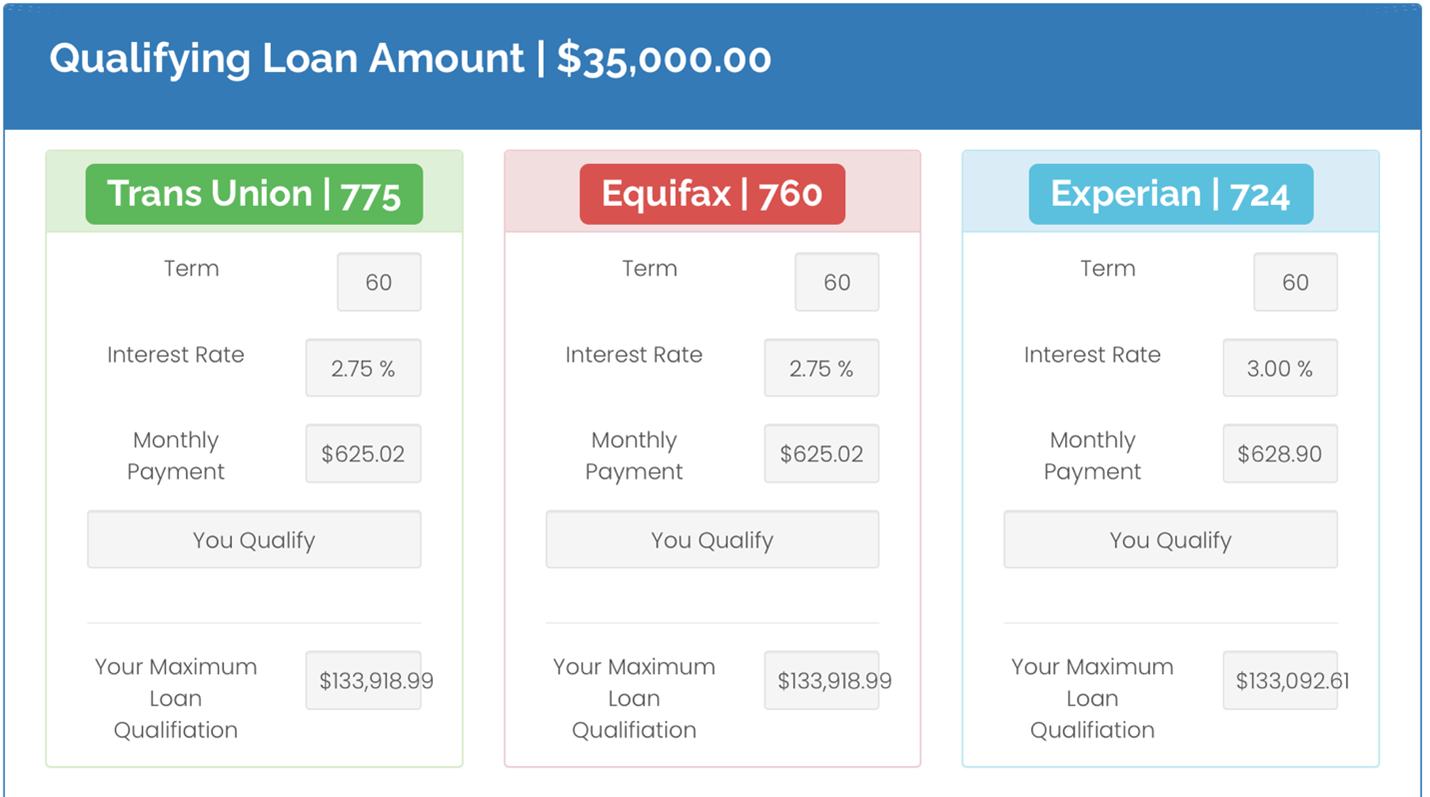

Auto Loan Qualifications

Similar to the mortgage loan qualifications, the auto loan interest rates adjust according to down payment, credit score and term. Auto lenders only use one FICO® score to qualify

consumers for an auto loan. By knowing this information, you can identify the best interest rate using the highest FICO Score.

In this situation, a person is looking at a five year term on an auto loan. The qualifying loan amount is $35,000. The consumer

must still have their income, assets and other information reviewed by a qualified lender - and credit scores may change from day to day.

This still is a one and only opportunity to check your loan qualifications before you go to a lender and start looking for a new car.