You want answers – now you have them at your fingertips, with My Credit Plan!

My Credit Plan has revolutionized home buying, car buying, and FICO® Score improvement. It offers credit score and lending tools not readily available anywhere else.

{My Credit Plan is managed by Family Financial, a certified non-profit credit counselor. Checking your report and lender’s Classic FICO® Scores through My Credit Plan does not create a hard inquiry and lower your scores.}

My Credit Plan provides you with:

- 3 Classic FICO® Scores & 3 Bureau Reports (Utilized by most Lenders)

- Credit Score Improvement (Industry Leading 81-Point average Improvement)

- Full-Spectrum Credit Analysis (Grades your Credit Report on 35+ Factors)

- Mortgage Central (Explore Your Home Purchasing Power)

- Auto Purchasing Options (Explore your Auto Purchasing Power)

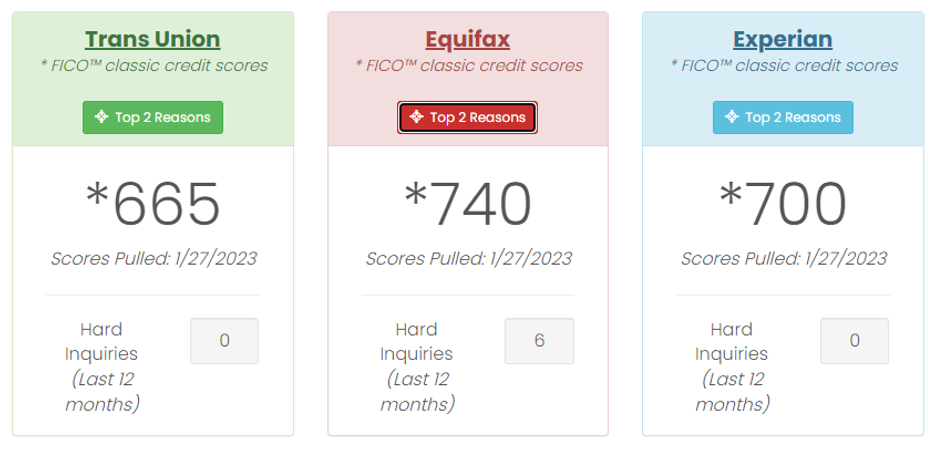

3 Classic FICO® Scores

There are 75+ different credit scores with over 50 of them created by FICO®. All of these scores produce a different 3-digit result. All mortgage lenders utilize the 3 Classic FICO® Scores that have a range of 300 to 850, and most lenders also use these 3 scores for other types of lending including credit cards and auto loans. Of the 75+ credit scores, these are the only 3 you should be tracking.

Don’t walk into a lender’s office to inquire about a loan with unreliable consumer credit scores in your hand. Access your lender’s 3 Classic FICO® Scores at My Credit Plan!

Program Plans

-

Gold (one-time set-up fee of $99.95)

Includes:

- Your Lender’s Classic FICO® Scores

- Personalized Solutions to FICO® Score Improvement

- Complete Credit Score Analysis

- Potential Mortgage & Auto Loan Qualifications

-

Silver (one-time set-up fee of $74.95)

Includes:

- Your Lender’s Classic FICO® Scores

- Complete Credit Score Analysis

- Potential Mortgage & Auto Loan Qualifications

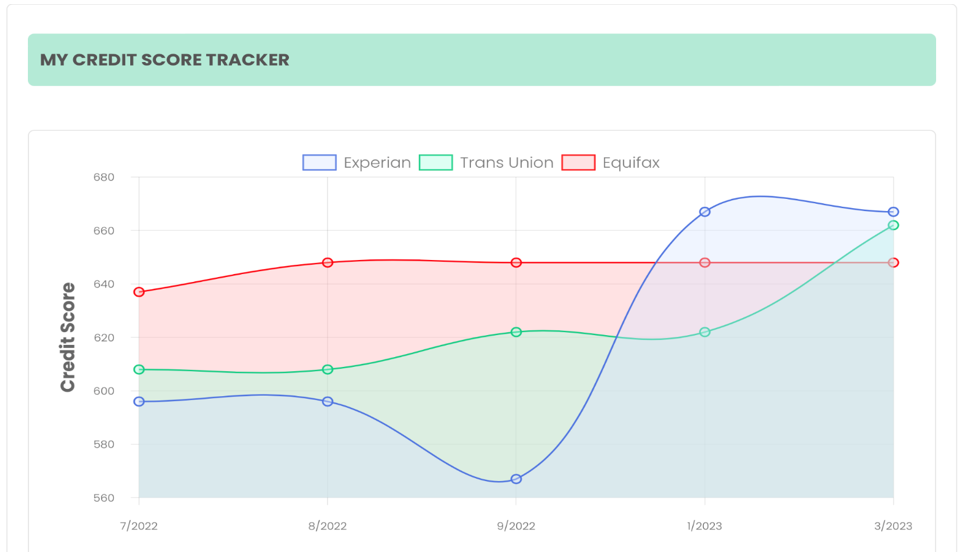

Score Tracker

A subscriber favorite. My Credit Plan provides options to consistently track your 3 Classic FICO® Scores. You can choose between one of the three following subscriptions:

- 3-score update ($54.95 monthly fee)

- 2-score update ($34.95 monthly fee)

- 1-score update ($18.95 monthly fee)

If you choose the 2-score or 1-score update, your scores will rotate between the three credit bureaus each month.

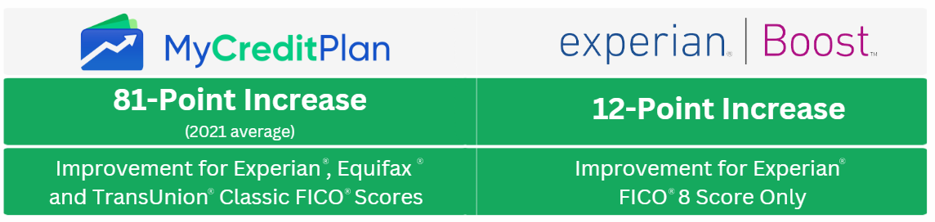

Credit Score Improvement

Results matter! The average results for My Credit Plan are far superior to any other credit improvement program.

My Credit Plan’s MaxScores™ Technology reviews your entire credit report for every identifiable solution to improve your FICO® credit scores. It analyzes the following:

- Accounts to Pay Down (by priority)

- Accounts to Close

- Accounts to Refinance

- Accounts to Leave Open and Use

- Open a Specific Loan Accounts

From the analysis, the program will reveal your estimated improvement and provide actionable steps to raise your scores.

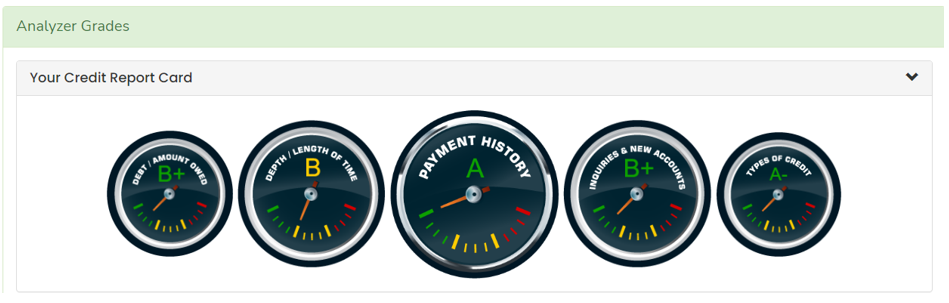

Full Credit Analysis

My Credit Plan provides a complete FICO® score analysis, reviewing the nearly three dozen factors that impact your lender’s credit scores. The program grades your credit on all the factors so you can effortlessly see what issues are lowering your scores.

No other score building program offers that!

Mortgage Central (Coming Summer 2023)

My Credit Plan provides powerful tools through Mortgage Central not offered by any other resource.

{The information provided is based on your lender’s 3 Classic FICO Scores, lender’s guidelines and real time interest rate information. It is for educational purposes only and is designed to better understand mortgages and select the best options for you.}

Mortgage Central offers four distinct tools:

- Identifies Your Potential Maximum Mortgage Qualifications

- Payment and Cost Options for a property of a Specific Sales Price

- Payment and Cost Options for a Specific Monthly Payment

- Reveals Your Potential Increase in Purchasing Power if your Credit Scores were to Increase (Usually Thousands of dollars)

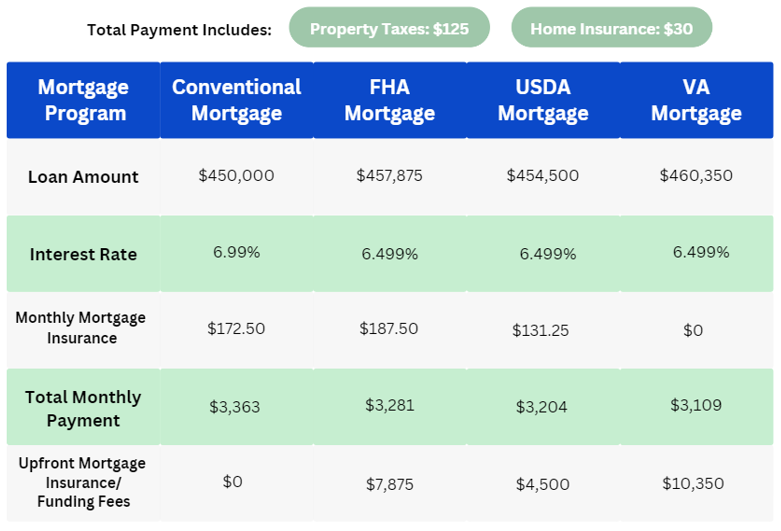

Mortgage Central utilizes your FICO® scores to compare all the major loan programs for you. The following chart reveals the mortgage options for a subscriber that wants to explore their payment possibilities for a home that is priced at $460,000.

My Credit Plan helps you determine which mortgage could be the best option for you depending on your qualifications.

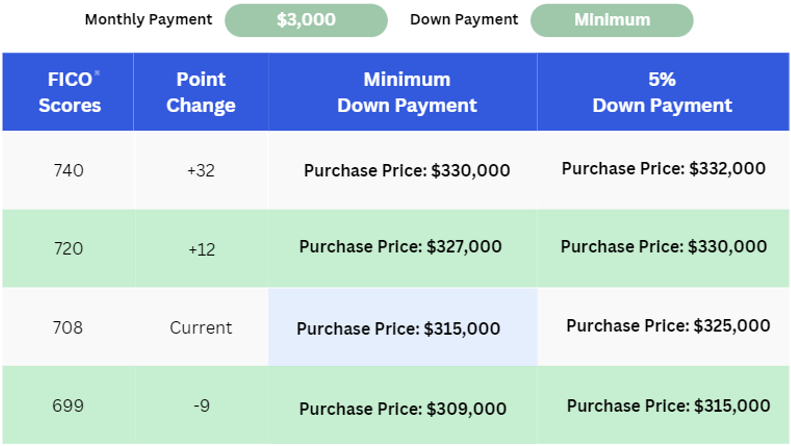

Increase Your Purchasing Power

My Credit Plan also provides an outline of your purchasing power if you were to increase your Classic FICO® Scores. It’s the only program that shares this information- so you can get more for less.

What could you do with thousands more in home purchasing power, if your monthly payment stays the same?

Auto Purchase Options

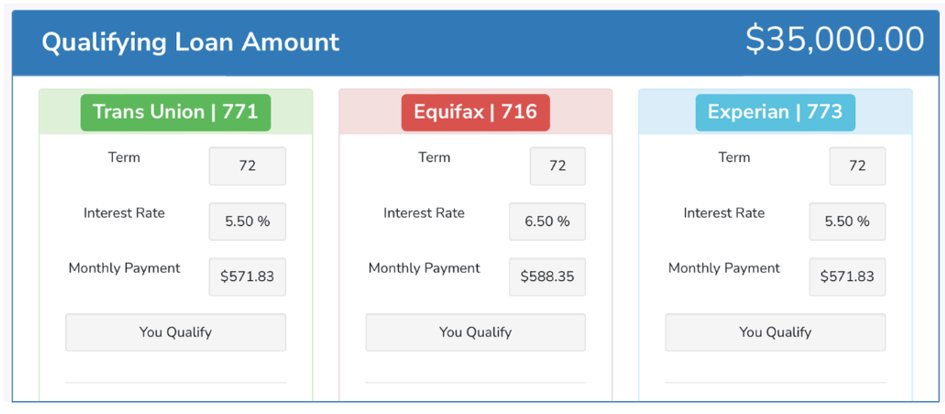

My Credit Plan utilizes your 3 Classic FICO® Scores and identifies the potential interest rates and payments when purchasing a car.

In this outline, a subscriber looks at their auto loan qualifications. This person would get the lowest interest rate and payment on a $35,000 auto loan using the Trans Union or Experian FICO® Scores. This is crucial to know before going into a lender’s office so you can secure the best deal by asking them to use your Experian or Trans Union scores for the loan.

Experience The MCP Difference

With My Credit Plan, you’ll be able to take your credit health into your own hands instead of relying on the outdated methods of credit repair companies. You’ll also be able to access powerful lending tools that instantly share information you could only otherwise get by sitting down with a proficient lender. Join us - and experience the credit wellness and financial peace of mind that thousands of subscribers have attained with My Credit Plan.